Investor Charter

Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

- To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available on the link [NSDL - https://nsdl.co.in/dpsch.php and CDSL - [https://www.cdslindia.com/DP/dplist.aspx]

(1) Basic Services

| Sr. no. | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 days |

| 2 | Rematerialization of securities | 7 days |

| 3 | Mutual Fund Conversion / Destatementization | 5 days |

| 4 | Re-conversion / Restatementisation of Mutual fund units | 7 days |

| 5 | Transmission of securities | 7 days |

| 6 | Registering pledge request | 15 days |

| 7 | Closure of demat account | 30 days |

| 8 | Settlement Instruction | For T+1 day settlements, Participants shall accept instructions from the Clients, in physical form up to 4 p.m. (in case of electronic instructions up to 6.00 p.m.) on T day for pay-in of securities. For T+0 day settlements, Participants shall accept EPI instructions from the clients, till 11:00 AM on T day. Note: 'T' refers 'Trade Day' |

(2) Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

| Sr. no. | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Value Added Services |

Depositories also provide value addedservices such as

|

| 2 | Consolidated Account statement(CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly(if no transactions) . |

| 3 | Digitalization of services provided by the depositories |

Depositories offer below technology solutions and e-facilities to their demat account holders through DPs:

|

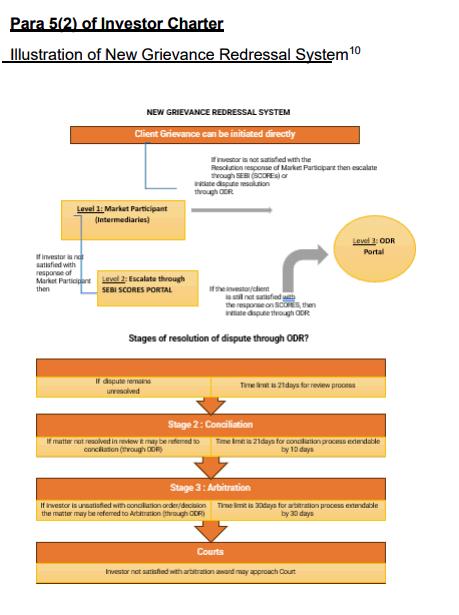

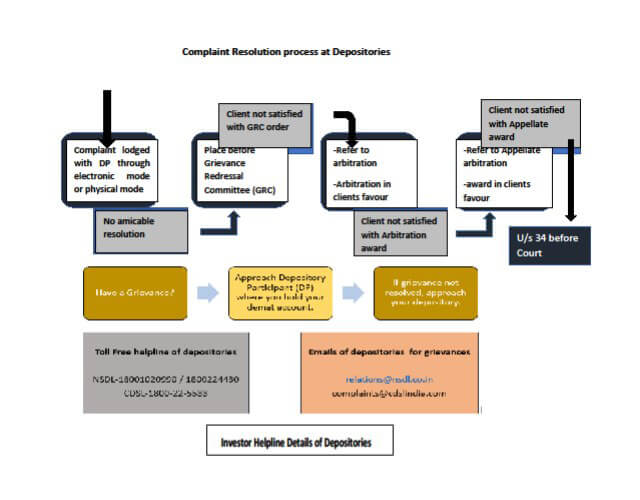

(1) The Process of investor grievance redressal

| 1 | Investor Complaint/Grievances |

Investor can lodge complaint/ grievance against the Depository/DP in the following ways:

(a) Electronic mode -

|

| 2 | Online Dispute Resolution (ODR) platform for online Conciliation and Arbitration | If the Investor is not satisfied with the resolution provided by DP or other Market Participants, then the Investor has the option to file the complaint/ grievance on SMARTODR platform for its resolution through by online conciliation or arbitration. https://smartodr.in/register |

| 3 | Steps to be followed in ODR for Review, Conciliation and Arbitration |

|

| Sr. no. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1 |

|

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

The StockHolding Advantage

domain knowledge